Python Finance Package v0.02: Basic Utils and Market Simulator

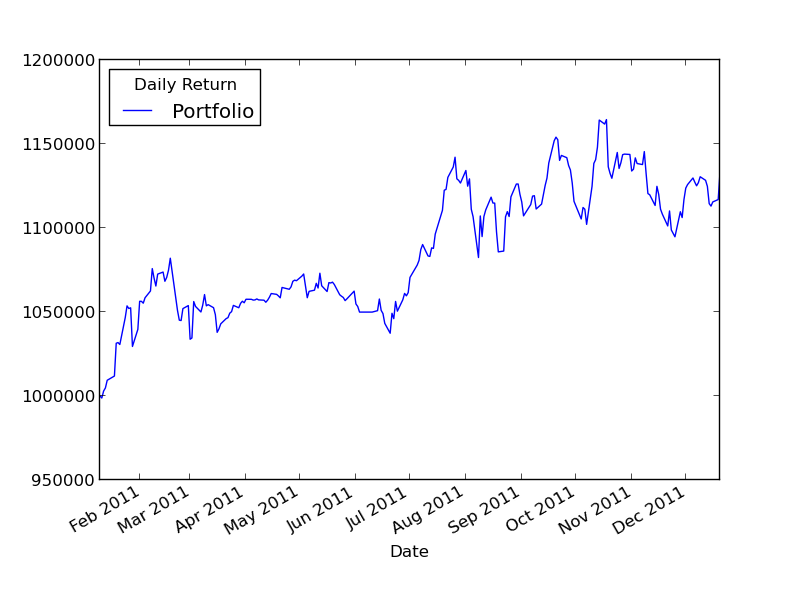

Continuing with the (Basic) Python Finance Package. Now has some basic utils: total-return, daily-returns, and sharpe-ratio calculations. Also a Market Simulator, the purpose was to solve the Computational Investing Homework 3.

Changes on DataAccess

- Now the index of the DataFrame is DatetimeIndex not string. With this is possible to index it with datetimes.

- Moved the classes folder from ’./data/’ to ’./utils/’

- Improved Documentation

Market Simulator

Reads a .csv file with the orders/trades. Downloads the necessary data (symbols and dates between the ). Makes a simulation of the orders:

The .csv file looks like this:

year,month,day,symbol,action,num_of_shares

2011,1,10,AAPL,Buy,1500

2011,1,13,AAPL,Sell,1500

2011,1,13,IBM,Buy,4000

2011,1,26,GOOG,Buy,1000

2011,2,2,XOM,Sell,4000

2011,2,10,XOM,Buy,4000

2011,3,3,GOOG,Sell,1000

2011,3,3,IBM,Sell,2200

2011,6,3,IBM,Sell,3300

2011,5,3,IBM,Buy,1500

2011,6,10,AAPL,Buy,1200

2011,8,1,GOOG,Buy,55

2011,8,1,GOOG,Sell,55

2011,12,20,AAPL,Sell,1200How to use it:

- Set the initial amount of cash

- Run the simulation, as an argument give the path to the csv file

- See the the information

from finance.sim import MarketSimulator

sim = MarketSimulator()

sim.initial_cash = 1000000

sim.simulate("MarketSimulator_orders.csv")

print(sim.portfolio[0:10])

import matplotlib

matplotlib.use('Qt4Agg') # Probably most people dont need this line

import matplotlib.pyplot as plt

sim.portfolio.plot()

plt.show()Output:

Portfolio

Date

2011-01-10 1000000

2011-01-11 998785

2011-01-12 1002940

2011-01-13 1004815

2011-01-14 1009415

2011-01-18 1011935

2011-01-19 1031495

2011-01-20 1031935

2011-01-21 1030775

2011-01-24 1046815

Basic Utils

With the portfolio ready we can get some info about it, for example the total return and sharpe ratio.

print('Total Return:', total_return(sim.portfolio, 'Portfolio'))

print(sharpe_ratio(sim.portfolio, extraAnswers=True))Which prints:

Total Return: 0.1338600000000001

{'std': 0.0071901402219816928, 'sharpe_ratio': 1.1836398092874625, 'mean': 0.0005493527495690362}Conclusion

Next step is to implement an Event Profiler to solve Homework 4.

Where to find the code? On github: PythonFinance