Python Finance Package v0.03 – Date Utils, Lists Utils, Event Studies

Continuing with the Python Finance Package. This update took longer because I change my setup to Linux (elementaryos), also things are getting complicated/interesting as my finance knowledge is mostly null, so I am learning as I develop the package, that was part of the plan so no complains about that.

The objective was to solve the Computational Investing Homework 4. Using the current code on the package (EventFinder + MarketSimulator) is possible to solve the homework, but I will cover that on a later post.

Changes since last time

- Bug fixes on File Manager and Data Access

- Improved tests

- Added Date Utils and List Utils to manage the open dates from NYSE

- Added Event Studies

- (Single) Past Event

- Event Finder

- Multiple Events

Date Utils

- Returns the dates the market was open between two dates.

- Looks for the closer date on a list of dates and returns the index of that date on the list

def nyse_dates(start=datetime(2000,1,1), end=datetime.today(),

insideSearch=True, list=False,

lookbackDays=0, lookforwardDays=0)

def search_closer_date(date, dates, exact=False, searchBack=True,

maxDistance=10)Example:

from datetime import datetime

from finance.utils import DateUtils

all_dates = DateUtils.nyse_dates(list=True)

print(all_dates)

print(DateUtils.nyse_dates(start=datetime(2008,1,1)))

index = DateUtils.search_closer_date(datetime(2009,1,1), all_dates)

print(index, all_dates[index])Output:

[datetime.datetime(2000, 1, 3, 0, 0),

datetime.datetime(2000, 1, 4, 0, 0),

datetime.datetime(2000, 1, 5, 0, 0),

...

datetime.datetime(2012, 12, 21, 0, 0),

datetime.datetime(2012, 12, 24, 0, 0),

datetime.datetime(2012, 12, 26, 0, 0)]

# Note: Length: 3268

2008-01-02 2008-01-02 00:00:00

2008-01-03 2008-01-03 00:00:00

2008-01-04 2008-01-04 00:00:00

2008-01-07 2008-01-07 00:00:00

...

2012-12-20 2012-12-20 00:00:00

2012-12-21 2012-12-21 00:00:00

2012-12-24 2012-12-24 00:00:00

2012-12-26 2012-12-26 00:00:00

Length: 1258

2262 2008-12-31 00:00:00

# Note 2009-1-1 was not open, closer date looking back is 2008-12-31List Utils

- Date Utils extends the List Utils of dates which only returns all the NYSE dates

- List Utils also provides the symbols from S&P500 each year

Example:

from finance.utils import ListUtils

sp500_2012 = ListUtils.SP500(year=2012)

print(len(sp500_2012), sp500_2012)Output:

501 ['A', 'AA', 'AAPL', ... ,'YUM', 'ZION', 'ZMH']Simple Past Event

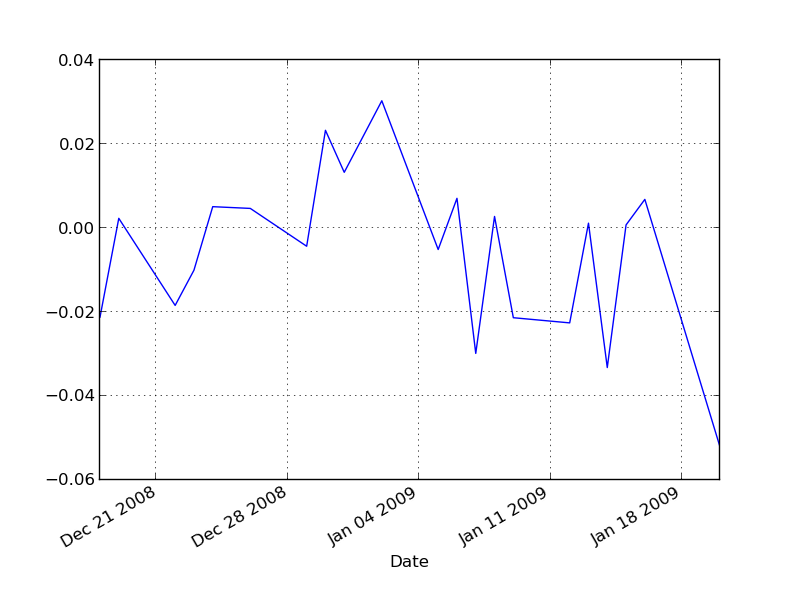

Input: date of interest, equity to analyze, market symbol to compare, event window length (back and forward) and estimation period length.

Output: The program downloads the necessary information and analyse the event: expected return, abnormal return, cumulative abnormal return, t-test.

Example (same from: http://www.youtube.com/watch?v=FRNabkJ48vs):

from datetime import datetime

from finance.evtstudy import PastEvent

pevt = PastEvent('./data')

pevt.symbol = 'AAPL'

pevt.market = "\^gspc"

pevt.lookback_days = 10

pevt.lookforward_days = 10

pevt.estimation_period = 252

pevt.date = datetime(2009, 1, 5)

pevt.run()

# print(pevt.expected_return)

# print(pevt.abnormal_return)

print(pevt.cumulative_abnormal_return)

# print(pevt.t_test)

import matplotlib

matplotlib.use('Qt4Agg') # Probably most people dont need this line

import matplotlib.pyplot as plt

pevt.expected_return.plot()

plt.show()Output:

Date

2008-12-18 0.024165

2008-12-19 0.028294

2008-12-22 -0.000580

2008-12-23 0.016884

...

2009-01-14 0.038178

2009-01-15 0.014626

2009-01-16 -0.004774

2009-01-20 -0.002890

Name: Cumulative Abnormal Return

# NOTE: Length: 21

Event Finder

Input: List of equities, date range to search for events, event_function [defaults: went_blow(amount), went_above(amount), increase(amount), decrease(amount)]

Output: Looks each equity on each date and creates an event matrix

Optional/Defaults:

- Loads/saves a cache (pickle) version of the data.

- By default only takes the first event on each equity

Example:

evtf = EventFinder('./data')

evtf.symbols = ['AMD', 'CBG']

evtf.start_date = datetime(2008, 1, 1)

evtf.end_date = datetime(2010, 12, 31)

evtf.function = evtf.went_below(3)

evtf.search()

print(evtf.num_events)

print(evtf.matrix)Output:

2

AMD CBG

Date

2008-10-27 1 NaN

2009-02-27 NaN 1Multiple Events

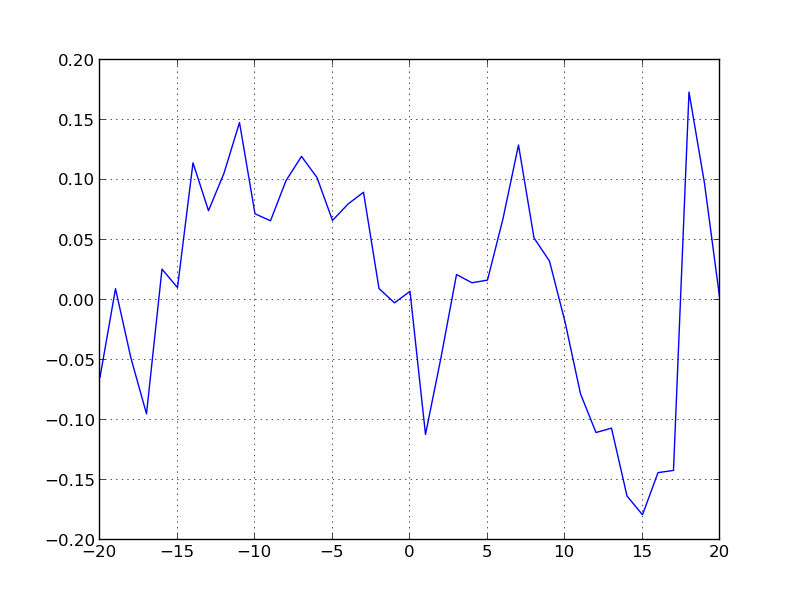

Input: Uses the matrix created on the Event Finder and analyse each event

Output:

- For each event

- Expected return

- Abnormal return

- Cumulative abnormal return

- Mean of:

- Expected returns

- Abnormal returns

- Cumulative abnormal returns

Example:

from datetime import datetime

from finance.evtstudy import EventFinder, MultipleEvents

evtf = EventFinder('./data')

evtf.symbols = ['AMD', 'CBG']

evtf.start_date = datetime(2008, 1, 1)

evtf.end_date = datetime(2009, 12, 31)

evtf.function = evtf.went_below(3)

evtf.search()

mevt = MultipleEvents('./data')

mevt.matrix = evtf.matrix

mevt.market = 'SPY'

mevt.lookback_days = 20

mevt.lookforward_days = 20

mevt.estimation_period = 200

mevt.run()

print(mevt.mean_abnormal_return)

import matplotlib

matplotlib.use('Qt4Agg') # Probably most people dont need this line

import matplotlib.pyplot as plt

mevt.mean_cumulative_abnormal_return.plot()

plt.show()Output:

-20 -0.064385

-19 0.073792

...

-1 -0.011918

0 0.009591

1 -0.119249

...

19 -0.076149

20 -0.097525

Conclusion

As usual the code is on github: PythonFinance

What is next? A more real-life example using ipython